Abstract:

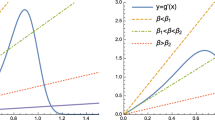

We address the issue of stock market fluctuations within Langevin Dynamics (LD) and the thermodynamics definitions of multifractality in order to study its second-order characterization given by the analogous specific heat Cq, where q is an analogous temperature relating the moments of the generating partition function for the financial data signals. Due to non-linear and additive noise terms within the LD, we found that Cq can display a shoulder to the right of its main peak as also found in the S&P500 historical data which may resemble a classical phase transition at a critical point.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Received 6 November 2000 and Received in final form 26 March 2001

Rights and permissions

About this article

Cite this article

Canessa, E. Langevin dynamics of financial systems: A second-order analysis. Eur. Phys. J. B 22, 123–127 (2001). https://doi.org/10.1007/PL00011127

Received:

Accepted:

Issue Date:

DOI: https://doi.org/10.1007/PL00011127