Abstract.

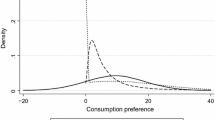

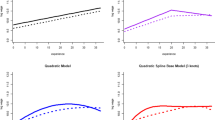

This paper expands the standard analysis of female labor supply to permit preference heterogeneity by using a finite mixture model. Using the extended model, we obtain theory consistent results whereas a traditional model produces a negative substitution effect. We use our model to illustrate the labor supply effects of a tax reform, corresponding to 1983–1992 changes in the Swedish income-tax schedule. The results shows an expected reduction in tax revenues of about 17%. Finally, we use Monte Carlo simulations and show that our proposed mixture model is robust towards different misspecifications.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

First version received: March 1998/final version accepted: October 1999

Rights and permissions

About this article

Cite this article

Ericson, P., Hansen, J. Assessing the impact of taxes on female labor supply using a finite mixture approach. Empirical Economics 25, 279–296 (2000). https://doi.org/10.1007/s001819900017

Issue Date:

DOI: https://doi.org/10.1007/s001819900017