Abstract

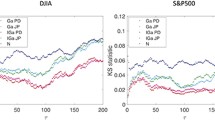

We investigate various distributional properties of German stock returns, like serial correlation, the existence of higher moments and calendar effects, with a focus on the robustness of various empirical measures to a nonstandard distribution of the returns. We exhibit the well known Monday effect also for German stocks, and show that its significance, like that of tests for serial correlation, depends on distributional assumptions which are often overlooked.

Similar content being viewed by others

References

Abraham A, Ikenberry DL (1994) The individual investor and the weekend-effect. Journal of Financial and Quantitative Analysis 29:263–277

Arad RW (1980) Parameter estimation for symmetric stable distributions. International Economic Review 21:209–220

Ariel RA (1987) A monthly effect in stock returns. Journal of Financial Economics 18:161–174

Bergström H (1952) On some expansions of stable distribution functions. Arkiv för Matematik 2 18:375–378

Box GEP, Pierce DA (1970) Distribution of residual autocorrelations in autoregressive-integrated moving average time series models. Journal of the American Statistical Association 65:1509–1526

Chamberlain TW, Cheung CS, Kwan CCY (1991) The friday the thirteenth-effect: Myth or reality? Quarterly Journal of Business and Economics 30:111–117

Davis R, Resnick S (1985) Limit theory for moving averages of random variables with regularly varying tail probabilities. Annals of Probability 13:179–195

Davis R, Resnick S (1986) Limit theory for moving averages of random variables with regularly varying tail probabilities. The Annals of Statistics 14:533–558

Efron B (1969) Student'st-test under symmetry conditions. Journal of the American Statistical Association 64:1278–1302

Fama E (1965) The behaviour of stock market prices. Journal of Business 38:34–105

Feller W (1971) An introduction to probability theory and its applications, 2 (2nd ed.). New York, Wiley

Fields MJ (1931) Stock prices: A problem in verification. Journal of Business 4:415–418

Frantzmann H-J (1987) Der Montagseffekt am deutschen Aktienmarkt. Zeitschrift für Betriebswirtschaft 57 7:611–635

French KR (1980) Stock returns and the weekend effect. Journal of Financial Economics 8:55–69

Gibbons M, Hess P (1981) Day of the week effects and asset returns. Journal of Business 54:579–596

Gultekin MN, Gultekin NB (1983) Stock market seasonality: International evidence. Journal of Financial Economics 12:469–482

Hill BM (1975) A simple general approach to inference about the tail of a distribution. The Annals of Statistics 3:1163–1174

Keim DB, Stambaugh RF (1984) A further investigation of the weekend effect in stock returns. Journal of Finance 39:819–840

Kim CW, Park J (1994) Holiday effects and stock returns: Further evidence. Journal of Financial and Quantitative Analysis 29:145–157

Kohers T, Kohli RK (1991) Week-of-the-month effect in pacific basin stock markets: Evidence of a new seasonal anomaly. Global Finance Journal 2:71–87

Koutrouvelis IA (1980) Regression-type estimation of the parameters of stable laws. Journal of the American Statistical Association 75:918–928

Krämer W (1994) Kapitalmarkteffizienz. In: Gerke W, Steiner M (eds) Handwörterbuch des Bankund Finanzwesens 1135–1143. Stuttgart, Schäffer-Poeschel Verlag

Krämer W, Runde R (1991) Testing for autocorrelation among common stock returns. Statistical Papers 32:311–320

Krämer W, Runde R (1992a) Wochentagseffekte am Deutschen Aktienmarkt—Wie robust ist dert-Test bei unendlicher Varianz? Allgemeines Statistisches Archiv 76 226–239

Krämer W, Runde R (1992b) The holiday-effect—yet another capital market anomaly? In: Schach S, Trenkler G (eds) Data Analysis and Statistical Inference: Festschrift in Honour of Friedhelm Eicker 453–461, Köln, Eul

Krämer W, Runde R (1993) Kalendereffekte auf Kapitalmärkten. Zeitschrift für betriebswirtschaftliche Forschung. Sonderheft 31:87–98

Krämer W, Runde R (1994) Some pitfalls in using empirical rutocorrelations to test for zero correlation among common stock returns. In: Kaehler J, Kugler P (eds) Econometric Analysis of Financial Markets 1–10, Heidelberg, Physica-Verlag

Lakonishok J, Levi M (1982) Weekend effects on stock returns—a note. Journal of Finance 37: 883–889

Lakonishok J, Maberly E (1990) The weekend effect—trading patterns of individual and institutional investors. Journal of Finance 45:231–243

Ljung GM, Box GEP (1978) On a measure of lack of fit in time series models. Biometrika 65:297–303

Logan BF, Mallows CL, Rice OS, Shepp LA (1973) Limit Distribution of Self-Normalized Sums. Annals of Probability 3:788–809

Mandelbrot B (1963) The variation of certain speculative prices. Journal of Business 36:394–419

Mason DM (1982) Laws of large numbers for sums of extreme values. The Annals of Probability 10:754–764

Milhoj A (1985) The moment structure of ARCH processes. Scandinavian Journal of Statistics 12:281–292

Penman StH (1987) The distribution of earnings news over time and seasonality in aggregate stock returns. Journal of Financial Economics 18:199–228

Runde R (1993) A note on the asymptotic distribution of theF-statistic for random variables with infinite variance. Statistics & Probability Letters 18:9–12

Runde R (1995) The asymptotic null distribution of the box-pierceQ-statistic for random variables with infinite variance-with an application to German stock returns. To appear in Journal of Econometrics

Schmittke J (1989) Überrendite am deutschen Aktienmarkt. Eine theoretische und empirische Analyse. Köln, Müller Botermann Verlag

Zolotarev VM (1986) One-dimensional stable distributions. Translations of Mathematical Monographs 65. American Mathematical Society. Rhode Island, Providence

Author information

Authors and Affiliations

Additional information

Research supported by ‘Deutsche Forschungsgemeinschaft’ (DFG). We thank two anonymous referees for helpful criticism and comments.