Abstract

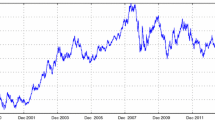

A discrete time approximation to the continuous time hyper-inflation model of Sargent and Wallace (1993) in which the authorities finance a given budget deficit by printing money appears to admit the possibility of chaotic solutions. In this paper we investigate the time series properties of daily observations on the Pound Reichsmark spot exchange rate in the inter-war hyper-inflation period. Our empirical analysis is suggestive that spot rates were generated by a non-linear possibly chaotic process.

Similar content being viewed by others

References

Beak, EG, Brock WA (1988) A nonparametric test for temporal dependence in a vector of time series. Unpublished manuscript Madison, University of Wisconsin

Brock W (1987) Notes on nuisance parameter problems in BDS tests for IID. Unpublished manuscript. Madison, University of Wisconsin

Brock W, Dechert WD, Scheinkman J (1987) A test for independence based on the correlation dimension. In Barnett W, Berndt E, White H (eds) Dynamic Economic Modelling. Proceedings of the Third International Symposium on Economic Theory and Econometrics. Cambridge University Press.

Brock W, Hsieh DA, LeBaron L (1991) Nonlinear dynamics, chaos and instability. MIT Press, Cambridge

Brockett RW (1976) Volterra series and geometric control theory. Automatica 12: 167–176

Cagan P (1991) Expectations in the German hyperinflation reconsidered. Journal of International Money and Finance 10:552–560

Chappell D (1993) Chaotic dynamics in a simple monetary model. Mimeo, University of Sheffield

DeCanio S (1979) Rational expectations and learning from experience. Quarterly Journal of Economics 93:47–57.

DeGrauwe P, Dewachter H, Embrechts M (1993) Exchange rate theory: Chaotic models of foreign exchange markets. Basil Blackwell, Oxford

Diebold FX (1987) Testing for serial correlation in the presence of heteroskedasticity. Proceedings from the American Statistical Association; Business and Economic Statistics Section 323-328

Eckmann JP, Ruelle D (1992) Fundamental limitations for estimating dimensions and lyapunov exponents in dynamics systems. Physica D 56:185–187

Einzig P (1937) The theory of forward exchange. London, MacMillan

Engle RF (1982) Autoregressive conditional heteroskedasticity with estimates of the variances of UK inflation. Econometrica 50:987–1008

Flood R, Garber P (1983) Process consistency and monetary reform: Some further evidence. Journal of Monetary Economics 12(2):279–95

Granger CWJ, Anderson AP (1978) An introduction to bilinear time series models. Göttingen, Germany Vanderhoeck and Ruprecht

Grassberger P, Procaccia I (1983) Measuring the strangeness of strange attractorst. Physica 9D: 189–208

Hsieh DA (1989) Testing for nonlinear dependence in daily foreign exchange rates. Journal of Business 62:339–368

Liu T (1989) How to decide if a series is chaotic. The estimation of correlation exponent. Unpublished manuscript. University of California, San Diego

Marcet A, Sargent TJ (1989) Least-squares learning and the dynamics of hyper-inflation. In: Barnett W, Geweke J, Shell K (ed) Economic Complexity. Cambridge University Press 119–137

Michael P, Nobay AR, Peel DA (1994(a)) The German hyperinflation and the demand for money revisited. International Economic Review 35:1–22

Michael P, Nobay AR, Peel DA (1994(b)) Purchasing power parity in the inter-war period-revisited. In preparation

Peel DA, Chappell D (1986) On stylized learning and hyper-inflations. Metroeconomica 38(2): 205–212

Peel DA, Speight A (1994) Testing for non-linear dependence in inter-war exchange rates. Weltwirtschaftliches Archiv 130(2):391–417

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75:335–346

Ramsey JB, Sayers C, Rothman P (1990) The statistical properties of dimension calculators using small data sets: Some economic applications. International Economic Review 31(4):991–1020

Ruelle D (1990) Deterministic chaos: The science and the fiction (The Claude Bernard Lecture, 1989). Proc R Soc London A 427:241–248

Sargent TJ, Wallace N (1973) Rational expectations and the dynamics of hyperinflation International Economic Review 14(2):328–50

Scheinkman JA, LeBaron B (1989) Nonlinear dynamics and stock returns. Journal of Business 62:311–367

Smith LA (1988) Intrinsic limits on dimension calculations. Physics Letters A 133:283–28

Subba Rao T (1979) On the theory of the bilinear time series models — II' technical report No 121. Dept of Maths University of Manchester Institute Science and Technology

Subba Rao T, Gabr MJM (1984) An introduction to bispectral analysis and bilinear time series models. Lecture Notes in Statistics 24. Springer New York

Taylor MP, McMahon PC (1988) Long-run purchasing power parity in the 1920s. European Economic Review 32(1):179–197

Weiss AA (1986) ARCH and bilinear time series models: Comparison and combination. Journal of Business and Economic Statisltics 4(1):59–70

Wolf A, Swift JB, Swinney HL, Vastanor JA (1985) Determining lyapunov exponents from a time series Physica 16D:285–317

Wollf RCL (1990) A note on the behaviour of the correlation integral in the presence of a time series. Biometrika 77:689–697

Author information

Authors and Affiliations

Additional information

We are grateful to L Allsopp, K White and J Sandhu for excellent research assistance. Also for comments from participants at the National University of Singapore and an anonymous referee and the editor of the journal. Needless to say remaining errors are our responsibility. The research was partly supported by the Leverhulme trust to whom we are grateful.

Rights and permissions

About this article

Cite this article

Peel, D.A., Yadav, P. The time series behaviour of spot exchange rates in the German hyper-inflation period: (Was the process chaotic?). Empirical Economics 20, 455–471 (1995). https://doi.org/10.1007/BF01180676

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01180676